In today’s global economy, individuals and businesses need to make cross-border payment as a common practice. Nevertheless, traditional methods of sending money abroad can be expensive, time-consuming, and confusing. Here comes advanced cross-border payment systems which employ smart features that foster overseas transactions, increasing their speed and efficiency. Cross border payment solutions provide quick, safe, and transparent payment methods that raise client satisfaction and boost business efficiency. Furthermore, these cross-border payments are essential for international trade and maintain global connectivity.

In this post, we’ll discuss how businesses can use advanced cross-border payment solutions to gain customer satisfaction.

So let’s get started!

Key Factors to Consider for Enhancing Customer Satisfaction

Transparent Fee Structures & Competitive Rates

Implementing transparent fee structures and offering competitive rates and discounts for regular users can enhance customer satisfaction. Customers appreciate fee transparency, and competitive rates will lower expenses and enhance the popularity of international transactions.

Real-Time Payment Processing

Implementing real-time payment processing systems and optimising transaction workflows for speed and efficiency are key factors in improving customer satisfaction. Faster transaction processing times reduce waiting times, enhancing the overall payment experience for customers.

Payment Status

Customers have the right to know the status of their transactions. Hence, provide clear and detailed transaction information to customers. Also, keep them updated on the payment status. Transparency in transaction details builds trust and confidence among customers, leading to higher satisfaction levels and client retention.

Intuitive User Interfaces

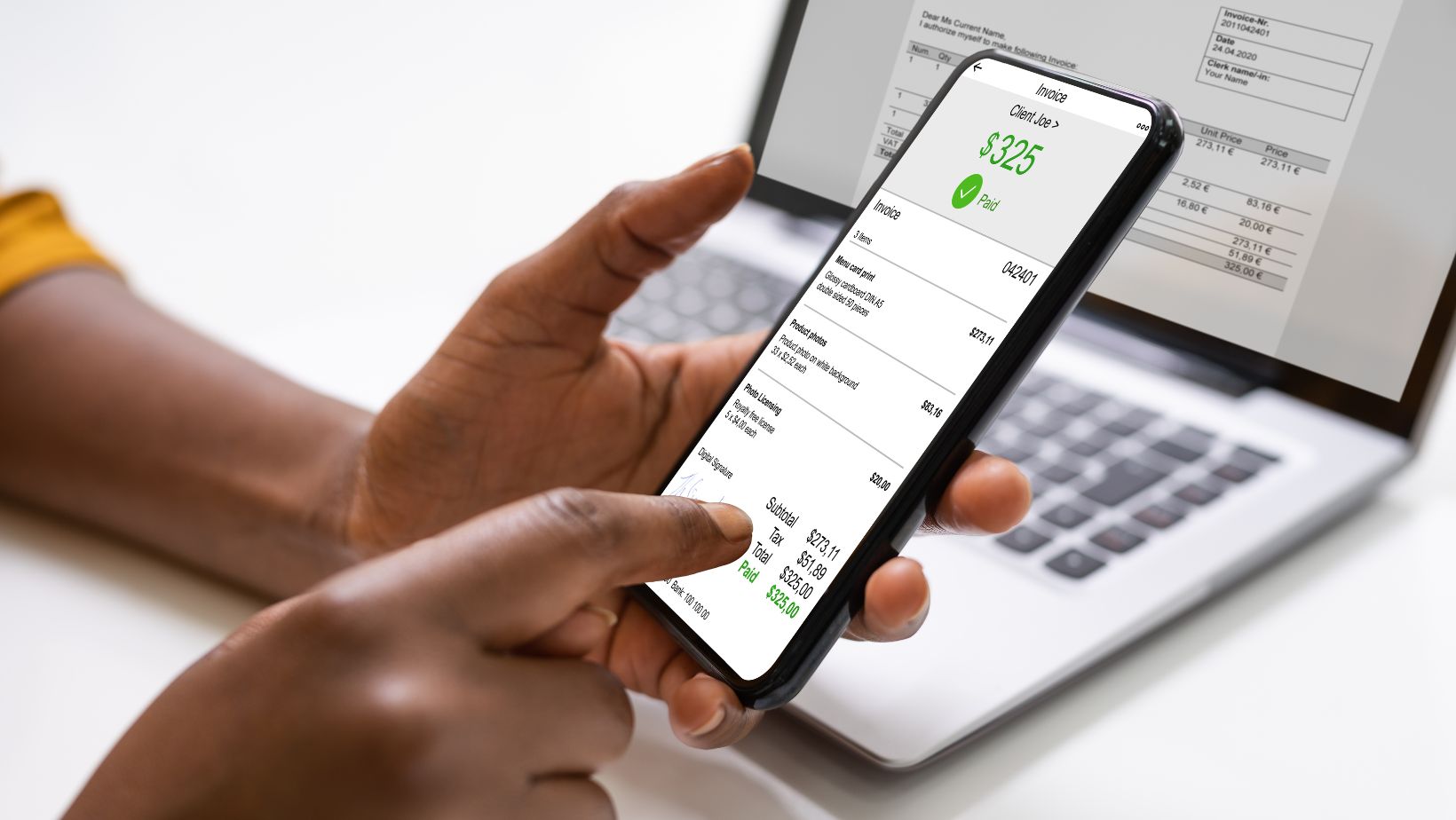

Your cross-border payment solution should be easy to use and navigate. A user-friendly interface makes it convenient for customers to make the payment process easily.

And this will ultimately enhance customers’ experience.

Robust Security Measures

When it’s about cross-border payments, how can we forget about security. To protect client data and transactions, it is essential to employ strong security measures like encryption and multi-factor authentication. Furthermore, to identify suspicious activity and protect customers from fraudulent transactions, integrate artificial intelligence (AI) into your cross-border payment system for fraud detection and prevention.

Multi-Currency Support and Competitive Exchange Rates

Offering flexibility for currency options will improve customer confidence for the payment system. Therefore, offer multi-currency support in your cross-border payment system to meet the various needs of customers and provide finest exchange rates for currency conversions. This will make international transactions more convenient and cost-effective.

Accessibility to Remote Areas

Ensure that your cross-border payment solution is accessible to everyone, including those who live in remote areas. Providing inclusive financial services and support will build trust and boost customer retention.

Personalised Support

Efficient transactions are not the only way to satisfy customers, providing tailored support and assistance whenever required is also important. Your advanced payment solutions must offer 24*7 dedicated support to address inquiries from clients, resolve issues, and offer guidance on how to use the payment platform efficiently.

Regulatory Compliance

Regulatory compliance becomes straightforward with an advanced payment system that ensures global regulatory compliance and automates KYC processes. You can effectively manage cross-border payment rules by centralising compliance processes and staying informed on advancements. Customers feel more confident in the payment process when compliance transparency is maintained.

The Positive Aspects of Cross-Border Payments

Global Trade and Commerce

International trade and business are simplified with advanced cross-border payment systems. It enables international business expansion, streamline transactions, and boost economic growth.

Financial Inclusion

Cross-border payments boost international financial inclusion by offering convenient and cost-effective payment systems. This way, it enables individuals and businesses in remote areas to get involved in the global economy.

Innovation and Competition

Cross-border payments drive progress in the financial sector by employing innovation, competition, and the development of efficient & customer-centric payment services.

Cost Efficiency

Embracing cross-border payments leads to cost reductions, increased transparency, faster settlement, and reduced hidden fees, benefiting both businesses and consumers.

Financial Stability and Risk Management

Advanced technologies like blockchain enhance financial stability, streamline processes, improve transaction traceability, mitigate fraud, and strengthen regulatory compliance.

Regulatory Compliance

Successful collaboration among financial institutions, fintech companies, and regulators ensures strong security, confidential data, and compliance to standards like know-your-customer (KYC) and anti-money laundering (AML).

Seamless Customer Experience

Cross-border payment systems provide seamless, user-friendly solutions by utilising innovative technologies, streamlined processes, and compatible platforms. It will ultimately enhance customer satisfaction and convenience in international transactions.

Advantages of Implementing Advanced Cross-Border Payment Solutions

Businesses are increasingly switching to advanced cross-border payment solutions to speed international transactions, improve efficiency.

Below we have shared the benefit of adopting advanced cross-border payment solutions that can enhance customer satisfaction and business success.

Speed and Efficiency

Advanced cross-border payment solutions can swiftly and efficiently process transactions. While traditional methods take several days to complete transactions, advanced cross-border payment solutions offer near-instantaneous fund transfers. This speed is particularly important for businesses operating in fast-paced industries where time is of the essence. This way you can meet customer expectations for timely transactions.

Cost-Effectiveness

Advanced cross-border payment solutions often come with lower transaction fees compared to traditional methods. You can invest these savings to improve their products and services or pass on to customers. This cost-effectiveness promotes long-term relationships based on mutual trust and value with your clients.

Enhanced Security

Security is paramount in cross-border transactions, since they include the transfer of confidential financial data between several legal systems. Strong security features including tokenization, multi-factor authentication, and encryption are all offered by advanced payment systems to protect consumer information and stop illegal access. Businesses that prioritize security provide their customers credibility by guaranteeing that fraud and cyber risks will not impact their financial transactions.

Transparency and Traceability

Advanced cross-border payment solutions provide real-time tracking and visibility into transaction statuses, ensuring that customers are informed every step of the way. From initiation to completion, customers can monitor their payments, verify recipient details, and receive confirmation once the transaction is successfully processed. This transparency builds trust and credibility, reinforcing customer satisfaction and loyalty.

Flexibility and Convenience

Advanced cross-border payment platforms offer a wide range of payment methods as per client preferences like digital wallets, internet transfers, or mobile payments, offering flexibility and convenience to their customers.

In a Nutshell

Adopting advanced cross-border payment solutions can help you significantly boost consumer satisfaction. These solutions provide a comprehensive approach to satisfying consumer demands and expectations, from faster processing times & lower transaction costs to improved security & personalized assistance. Investing in advanced payment solutions is a vital part of success in today’s global marketplace.