The average true range (ATR) is a technical analysis indicator that measures price volatility and takes into account price gaps. This volatility indicator is a great tool to use in conjunction with other tools, such as moving averages and RSI indicators. It is particularly useful when attempting to find potential breakout points or to define stop-loss orders.

The ATR was originally created by J. Welles Wilder and featured in his book “New Concepts in technical trading systems,” which was published in 1978. It is a popular volatility indicator and one that many traders are familiar with. Traders often use the ATR to identify periods of high and low volatility in a market, as this can lead to profitable buy or sell signals.

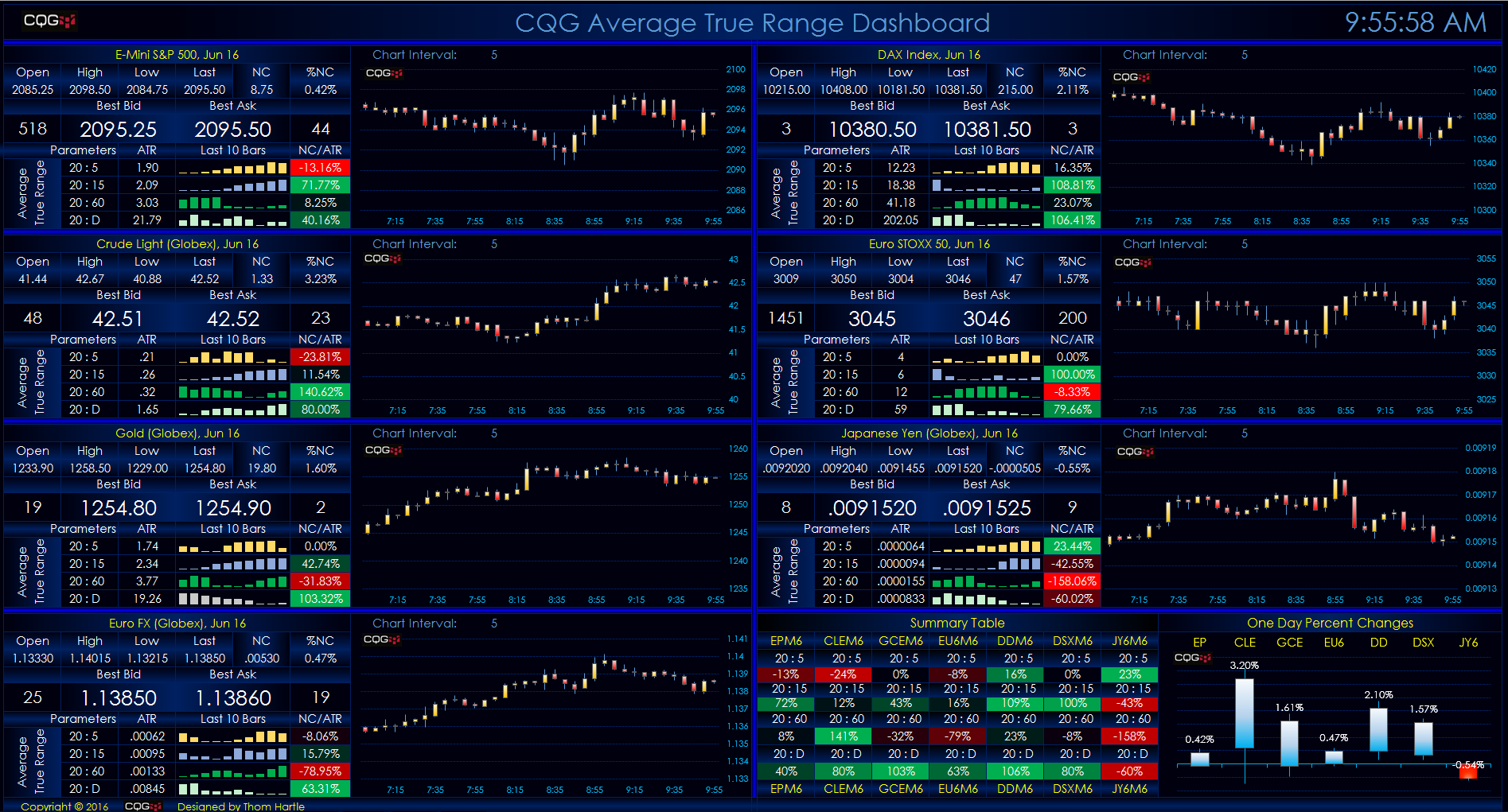

To calculate the ATR, analysts take the sum of all the ranges that security has experienced over a given period and divide it by the number of observations used to make that calculation. This is then multiplied by the standard deviation of those ranges to get an indication of how volatile a market or individual asset has been. The ATR is typically based on 14 days but can be calculated using a shorter period if desired.

Unlike some other volatility indicators, the ATR does not take into consideration price direction and is best used as a complement to other more active tools which can be more accurate at predicting future price movements. However, the ATR can provide an indication of how strong a particular move or reversal is; for example, if prices rise significantly and the ATR has increased, then this could indicate that there is a lot of interest or pressure reinforcing that movement.

The ATR is often used in conjunction with other popular technical analysis tools such as moving averages, RSI, and the MACD indicator to help identify trend direction and confirm potential trading opportunities. It is also a key indicator when trying to identify potential breakout points, as it can be indicative of when the volatility in a market will increase or decrease.

The ATR is an essential indicator to learn for anyone involved in trading and should be a part of every trader’s toolkit. To ensure that you are getting the most out of this volatility indicator, it is worth experimenting with different settings in your charting software and logging the results in your trading journal. This will help you to decide which setting is most effective for your particular strategy and trading style. Alternatively, many online trading platforms have the option to automatically generate an ATR for you so that you don’t need to do this manually.

This will save you valuable time and effort so that you can focus on the more important aspects of your trading. The more you learn about this and other volatility indicators, the better trader you will be. Good luck! Traders, if you have any questions regarding this article or would like to discuss any other topics relating to trading, please leave a comment below.