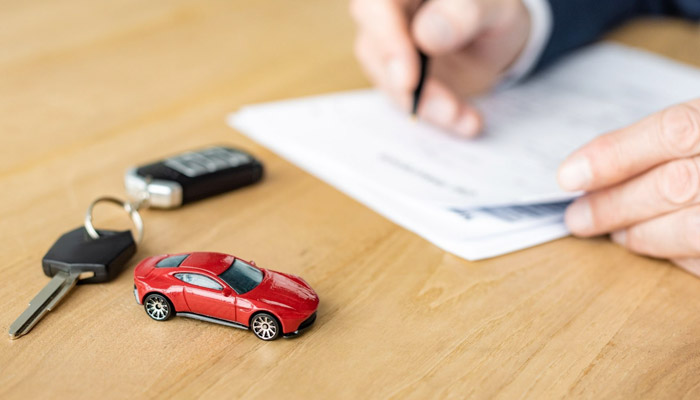

When searching around to get the relevant info about different car financing options, you have probably noticed the term unsecured car loan. Generally, when you buy a car by using a regular or secured loan, you must place the vehicle you get as collateral in case you cannot repay the loan.

On the other hand, unsecured options are standard for upgrades and repairs, meaning situations where you do not place any item as a guarantee or collateral. Still, you can receive an unsecured car to purchase it from scratch. Therefore, you should understand the type you wish to get before signing anything.

Differences Between Unsecured and Secured Car Loans

The biggest differences between these two options come in the form of security or collateral. When you take a secured option, you must place an asset you wish to buy as collateral, meaning a lending institution will seize it in case you cannot repay the amount you have taken.

However, when you take advantage of an unsecured car debt, you will not use your vehicle or any other asset as collateral. Instead, you should choose a co-signer who will guarantee that you will repay everything on time. We are talking about an individual who will take over the payments in case you stop paying.

You should visit this link: billigsteforbrukslån.com/lån-til-traktor to learn the type of loan you should get to purchase a tractor. The biggest differences between these two options are:

No-collateral counterparts generally have shorter terms and variable or fixed rates, and they are more challenging to qualify for because you will need an excellent credit score for the process. Secured options feature longer terms and fixed interest rates in most cases, and you can qualify with an average score, which is not the case with others. If you do not wish to lose a vehicle when you stop paying, an unsecured loan will provide you with better peace of mind. However, if you have score issues, then the secured option is better and more affordable.

Should You Choose an Unsecured Car Loan?

Using a vehicle as collateral is additional protection to lenders, meaning it features lower interest rates, and they are simpler to get than others. The main disadvantage lies in the idea that they can seize your asset if you miss payments. Although you will get the potential for low-interest rates and short terms, you should know they will offer you peace of mind. In most cases, loans for expensive belongings or assets such as cars or homes require collateral as purchased items.

When it comes to unsecured car loans, you can take advantage of a personal loan, which will allow you to handle the process without using collateral. However, if you default, lenders will sell your debt to a collection agency and take you to court, which means you will still end up paying by garnished wages, for instance, but without repossession.

Getting an unsecured car loan comes as a consumer or personal debt you can use to purchase a used or new car. Since you will not use collateral, you can rest assured. Still, you should consider that they require better credit scores for qualification, and you will end up with higher interest rates and shorter terms than the regular options you can choose. Taking advantage of an unsecured car loan is like getting a personal loan. The process starts by searching for the best lenders available on the market who will offer you this particular option. You can search online and visit their websites to learn more about application processes.

At the same time, you can talk with local credit unions and current banks. You must determine whether they offer different debt options. As soon as you find a lender whose interest rates and terms work for you, the next step is submitting the application and paperwork. The documentation you should submit includes your employment history and information about your financial situation, such as savings, debts, income, and residence. At the same time, the lender will conduct a hard inquiry into your credit score.

Most of them have minimum score requirements, meaning the best course of action is to apply when you reach at least seven hundred points or more. The moment they approve you, the next step is to get a complete amount, and then you can go to a private seller or dealership and use the money to purchase the car you wanted in the first place. In some situations, it is smarter to take advantage of a personal loan to purchase a car, but in specific cases, it may be the only option available to you due to numerous reasons.

- You Cannot Find Conventional Financing – For instance, if your goal is to purchase a vehicle of a certain age, you may not be able to take advantage of traditional loans or financing methods. Some banks or lenders will set the cap and do not allow you to use the loan to purchase a vehicle older than ten years. At the same time, some lenders will require older vehicles to have less than a hundred thousand miles to finance.

- Unsecured Loans May Feature Lower Rates than Traditional Car Debt – Although interest for others generally higher due to the inability to place anything as collateral, if you have an outstanding credit, you can qualify for a competitive option, which may be the same or even lower than traditional. As a result, you will get the same terms and rates while protecting your assets. The best way to learn more about different unsecured loans you can take is by checking here for additional information.

Advantages of Using Unsecured Car Loan

One of the biggest advantages of using financing is the ability to get the funds you need without placing a guarantee in the form of collateral. Since the vehicle will not act as collateral, you can rest assured because you enter a point where you cannot handle the payments, no one could repossess your car, but your score will plummet.

Compared with the secured option, where you must find the car first before securing it for your specific needs, with this particular option, you can make money first and then search for the best option available on the market. This is highly important if you wish to avoid going to dealerships and buying from private sellers. You can also avoid making a down payment on the purchase when using the unsecured option, which is another reason for its popularity.

Final Word

The main problem with personal loans you can use to purchase vehicles is the more significant risk for lending institutions and higher approval requirements, meaning you will end up paying higher interest rates in the short term. Still, you can rest assured and avoid potential problems that may happen in case you stop paying, which is an important consideration to remember.